How do we save Australia?

The financial equivalent of washing our hands and self-isolating

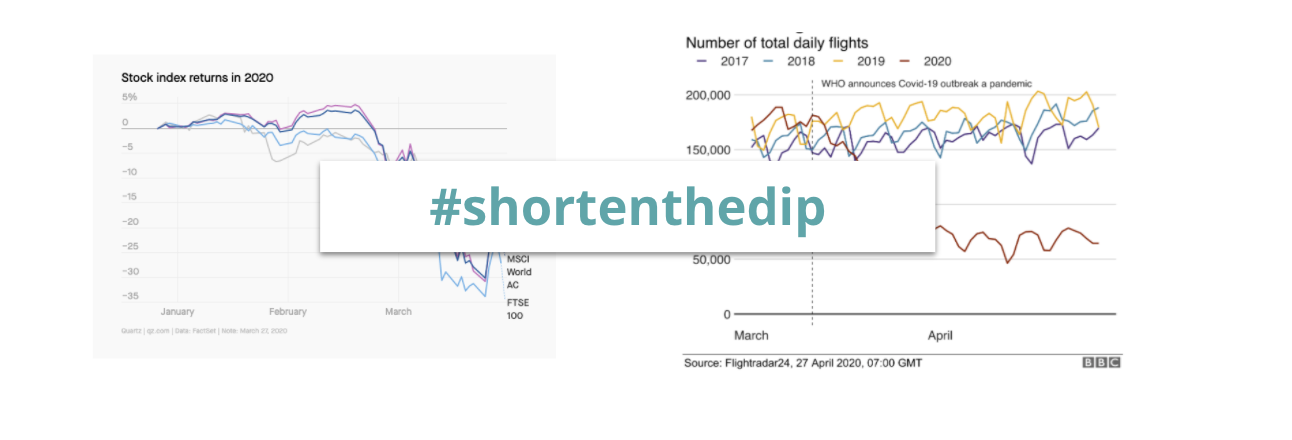

Over the last 6 weeks, we’ve come together as a country by staying apart. In so doing, we’ve successfully managed to #flattenthecurve of new coronavirus cases in a way that has made us the envy of the world. But now that we’ve flattened the curve medically, it’s time to discuss how we can manage the consequences of that action economically. We need to work together to #shortenthedip.

There are theories about ‘economic hibernation’ and ‘V-shaped recovery’ that are yet to be proven – the central idea being that we can simply turn off entire industries or sectors for a period, and then turn them on again as if nothing happened (with some government cash injected in the interim). I’m not convinced that’s going to happen. I think we’ll be living with the effects of this for some time, even if it’s just the public debt that’s accrued as a result, and the loss in confidence following such a massive and unexpected shaking up of our daily lives.

But this isn’t about being an economic doomsayer. In fact, I’m inherently optimistic – because I believe we all have a choice. And better choices can lead to better outcomes.

In the movie Minority Report, there’s a climactic scene where the main character finds himself in a situation that was foretold by the ‘pre-cogs’ – basically clairvoyants – and suddenly realises that he’s living out the prophecy down to the very last detail. Then, just when it all seems a foregone conclusion, one of the prophets desperately whispers ‘You can choose… You. Can. Choose!’

So the stage may have been set for enduring economic pain, but we now get to write the script. We. Can. Choose. Should we choose well, we will #shortenthedip as successfully as we flattened the curve.

And just like flattening the curve, there’s a role for everyone to play. As people in healthcare had an advocacy role on the health side, it’s time for people in the business sphere to start rallying people to the economic cause in a cohesive, understandable way.

just like flattening the curve, there’s a role for everyone to play

Why? It’s not about making money, although that might be part of it for some. It’s about livelihoods and societal consequences when those are under threat. It’s about what happens when people’s blood, sweat, and tears evaporate – through no fault of their own – and leave behind debts, regrets, and despair. It’s about what happens when people lose the utility of a job – the ability to pay their bills – and the sense of purpose that comes with it. It is, fundamentally, a question of hope.

That’s why I find it strange that we keep having conversations that delineate the economy and health as if they’re entirely unrelated. The economy is part of health: it pays for our health systems, and our economic health enhances the physical health of our people.

That’s why I care about our economy – because I care about people.

So let’s talk for a moment about what happens when we lose our economic health. Specifically, the effect this has on mental health. There’s a clear link between economic depression and suicide. I’ll use US figures as an example, as the historical figures are more readily available. In the US, the suicide rate increased 33 percent between 1999 and 2017. The rate now sits around 13.42 per 100,000. However, this still doesn’t compare to the peak of 22.9 per 100,000 during the last year of the Great Depression, after suicide rose by nearly 25% in just four years in a case of clear causation between economic depression and mental depression.

And that’s why I care about our economy – because I care about people.

Which is all to say that while the talk is largely focused on health, businesses matter and the economy matters. We must take seriously our responsibility to #shortenthedip.

SAVING AUSTRALIA

If we’re going to save Australia economically, what are the financial equivalents of washing our hands and self-isolating?

We have become so debt-driven as a society, that we now have people asking questions like this.

Not spending more than you earn, so you’re not paying interest and late fees, is the most basic financial hygiene factor. It’s the equivalent of washing our hands as the first way to protect ourselves.

By practicing good financial hygiene, we’re better positioned to help save Australia – by ensuring fewer of us need to be caught by the welfare net.

Not spending more than you earn is closely followed by saving, which is the first step towards getting ahead financially.

The Savings Catch

The problem with saving, as Rory Sutherland once put it, is ‘Marketers tend to view it as consumerism needlessly postponed’. The weight of advertising is out there encouraging you to buy now/have it all and why wait?

‘Marketers tend to view it as consumerism needlessly postponed’ – Rory Sutherland

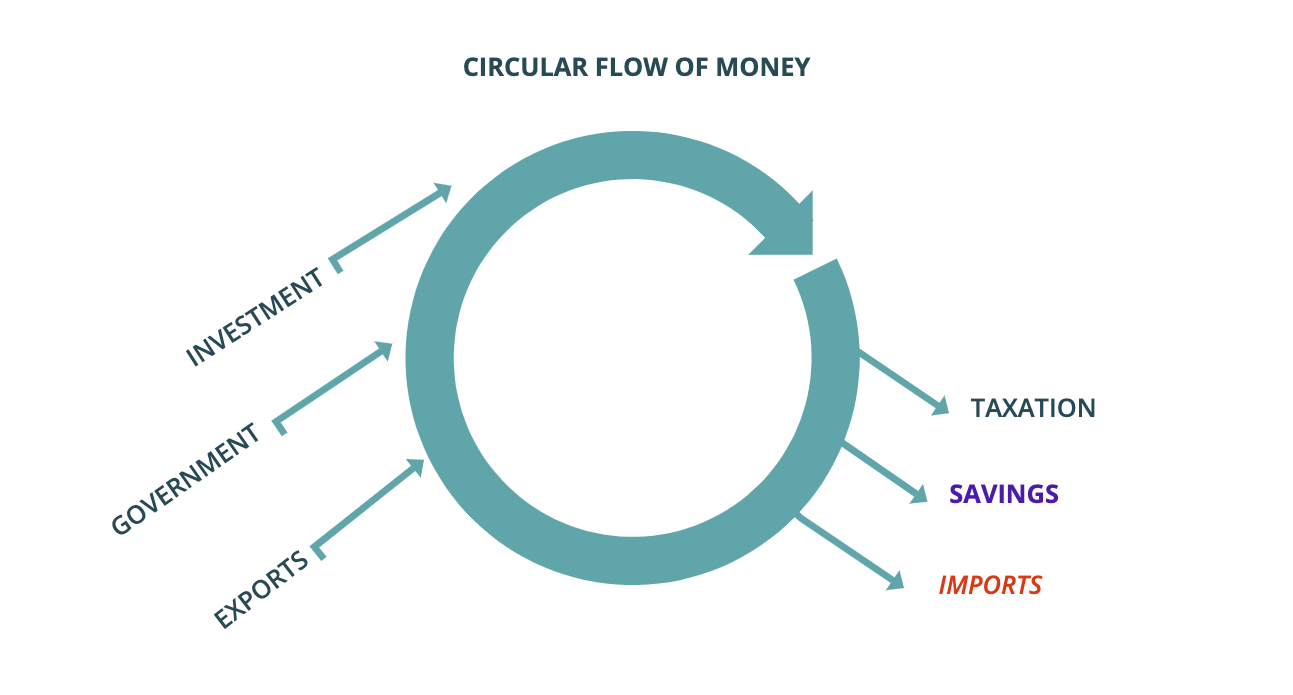

Savings has been discouraged, by everyone from governments chasing endless economic growth to businesses trying to flog you a cheap t-shirt. In the case of businesses, that’s self interest; and in the case of governments, that’s because savings are considered a leakage in the circular flow of money.

But postponing spending isn’t the same as cancelling it.

It has a delay effect, but that’s not a great concern if it’s ultimately spent. The bigger question is where or how those savings are spent.

Cue the next leakage: imports.

When you buy an imported product, the cost for producing it is sent out of the local economy and so isn’t available to be recycled through it, via the multiplier effect (I pay you, you pay someone else, they pay the next person, and so on). This actually happened with many of the stimulus payments during the GFC. People took overseas holidays, or bought a Chinese-made Kogan TV for $900, and a giant part of that money left the country.

Well, that happened quickly…

Ok, let’s have a look at some economic impact figures, and our federal government’s responses.

- January 28, 2020: it was all “Bad news on bad news” with the coronavirus expected to deliver a $2.3 billion hit to the Australian economy (by May 5th, it was costing us $4 billion per week).

- By March 9, it was looking like the federal government would provide a $3 billion stimulus package, although some reports indicated it could possibly be as high as $10 billion.

- By March 30, the government response totalled $320 BILLION.

That’s not an argument against those measures, it’s just the reality.

So, you might see where this is going: What’s the financial equivalent of ‘self-isolating’?

It’s buying Australian.

It’s ensuring that the money which we’ve all just borrowed, as citizens (via our government proxy), doesn’t get leaked out of the country. It’s a simple idea, but it’s pretty hard to do; there are not too many consumer products that we produce here anymore. We have some great Australian brands that contract manufacture overseas and then import (hello Bonds and Breville!) but not many products made here employing local people who pay local taxes. But that’s ok – because we’re a service-driven economy, right? Except that we have a problem, because our service economy is mostly not allowed to serve right now. Holidays? Banned. Restaurants? Shut. Concerts? Cancelled.

That’s not an argument against those measures, it’s just the reality.

So what have we done as a population so far? We’ve stocked up on (mostly Australian) groceries and alcohol. Bought we’ve also bought more Netflix subscriptions (+26%), a platform that generates almost no local jobs and pays almost no local tax. And we’ve ramped up our use of Uber Eats to get food delivered, meaning another international platform takes a huge clip out of a local business, and then the money leaves the economy again. Businesses are increasing their technology spend, but most of the platforms they’re using are also foreign owned (with the notable exception of these guys).

What’s the answer? Well, the shutdown won’t last forever… so we need to think about the other side.

And we need to think about it together, and create a sense of mutual accountability. We need to work together to Save Australia.

Remember how we wanted to help save the regional towns after the bushfires hit, by going and spending money in those regions? This is the same idea, but on a much bigger scale – because the problem is much bigger.

Remember how we wanted to help save the regional towns after the bushfires hit, by going and spending money in those regions?

You can register to signal your participation here.

Let me point out that while we’re driving this thing, we don’t intend to monetise it. People are welcome to use the Nudge Saver app or not; any Australian businesses we ultimately list in the directory of goal inspiration will be free. It’s about creating the awareness, the intent, and the follow-through action that matters. As people responded in whatever way they could on the health side, this is our way of using the tools in our hands to respond to the situation in front of us. As a fintech, we can’t help with the health side – but I’m hoping we can do our bit for the economic side and, in so doing, help to #shortenthedip.

I hope you’ll consider becoming part of the movement, and encouraging others to do the same. We’ve fared better than anyone expected on the health side, but the economic consequences are still yet to be determined – and the health outcomes with them. But… We. Can. Choose.

And I hope we’ll choose well. Our economy, and ultimately our health, will depend on it.

Thank you.

It’s time to Save Australia

This is part of our initiative to #shortenthedip. We can each do our bit to help with the economic recovery, by saving and then spending locally.